PT kHYPE

To say the Hyperliquid ecosystem is buzzing would be an understatement... the last few weeks have seen a series of momentous announcements and developments which should not go amiss.

Before we dig into today’s topic (the kHYPE Pendle market), I first want to touch on some of the wider developments which are setting the Hyperliquid ecosystem ablaze:

Native USDC and CCTP V2 on HyperEVM

Pendle joins Curve Finance as the 2nd bluechip defi deployment on HyperEVM (only a matter of time before Uniswap and Aave join the party too)

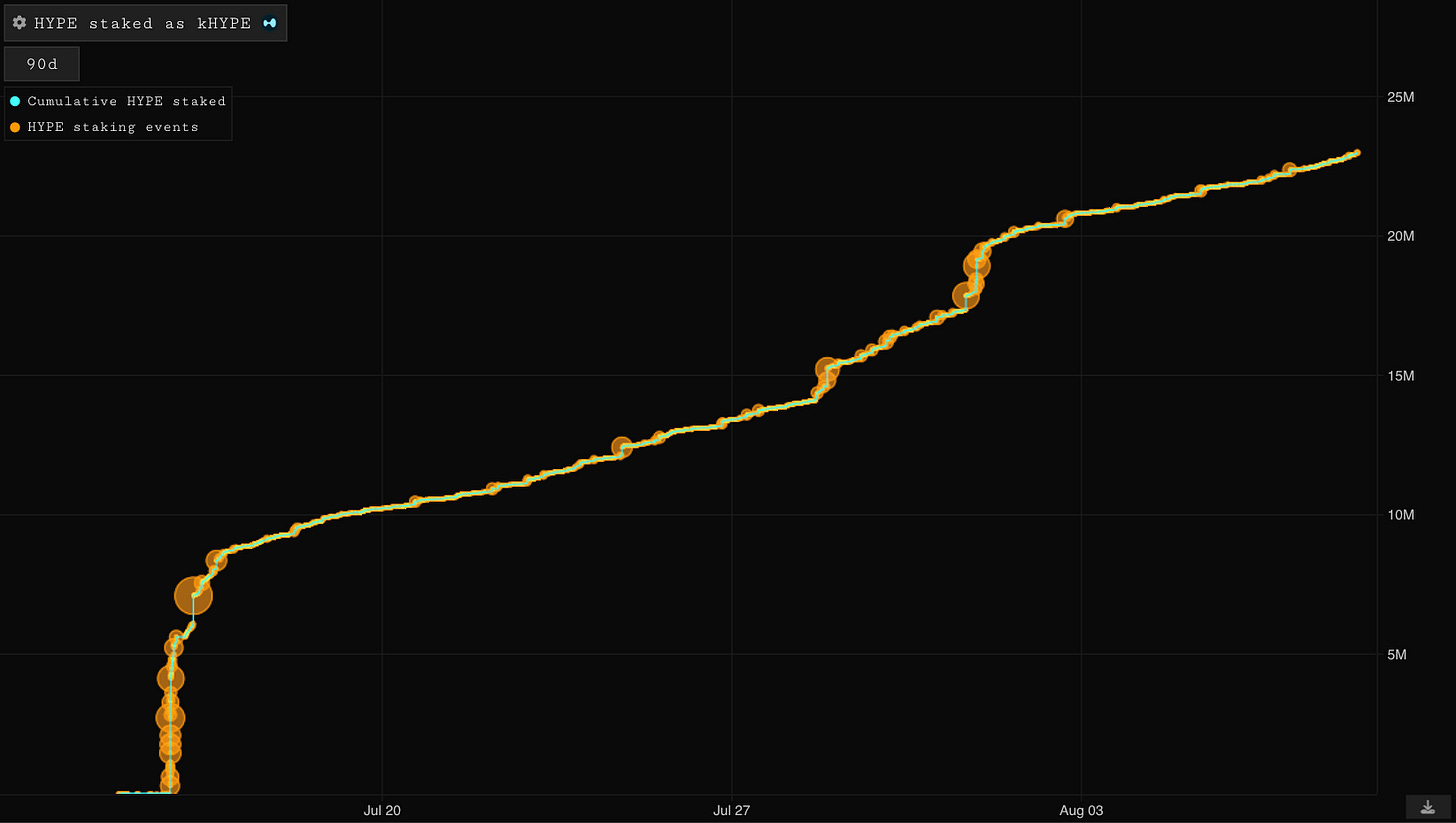

kHYPE tops $1 billion in TVL (shown below)

HIP-3 vision becoming clearer by the day with multiple early adopters coming out of the wood work (Ventuals, Chainsight, Volmex)

The latter point brings me closer to the topic of the day. The 31st of July saw Kinetiq announce Launch, a product which strives to be an instrumental part of bringing HIP-3 to life.

In short, Launch seeks to create “Exchange-as-a-Service”, letting anyone spin up their own perpetuals exchange on top of HIP-3 without needing the 1M HYPE stake.

Contributors stake HYPE into isolated exchange-specific pools (exLSTs) in return for a share of fees and governance. This risk-isolated model means backers choose the teams and markets they believe in, while deployers focus on curation, community, and market design.

Given the potential here, this could take Kinetiq from a cool liquid staking protocol (given the Corewriter synergies we discussed here) to something a lot bigger and more instrumental in the success of HIP-3 and Hyperliquid more broadly.

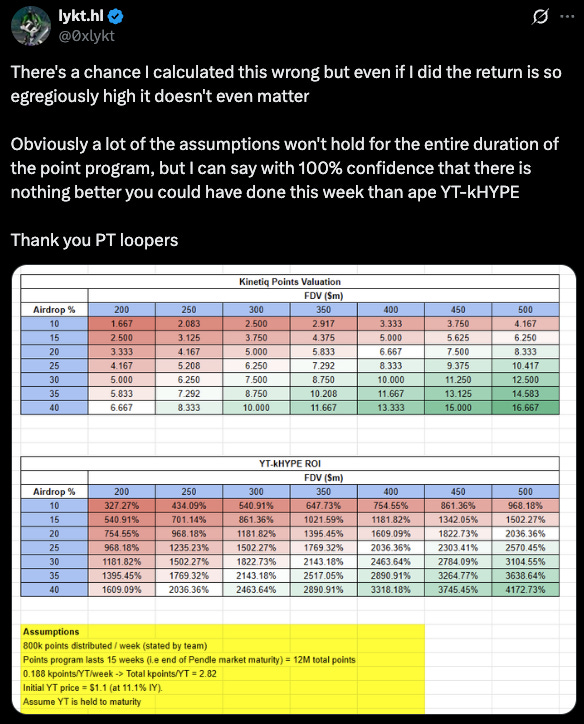

The timing of the Launch announcement has taken place at an interesting time given Kinetiq’s recently launched points program and Pendle’s launch of a kHYPE market. Naturally this has sparked a lot of conversations about what Kinetiq points might be worth...

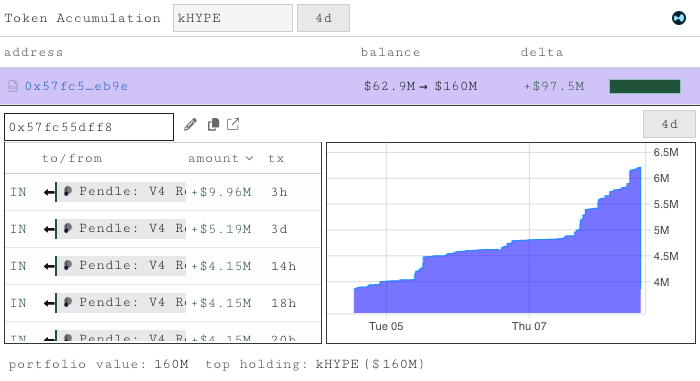

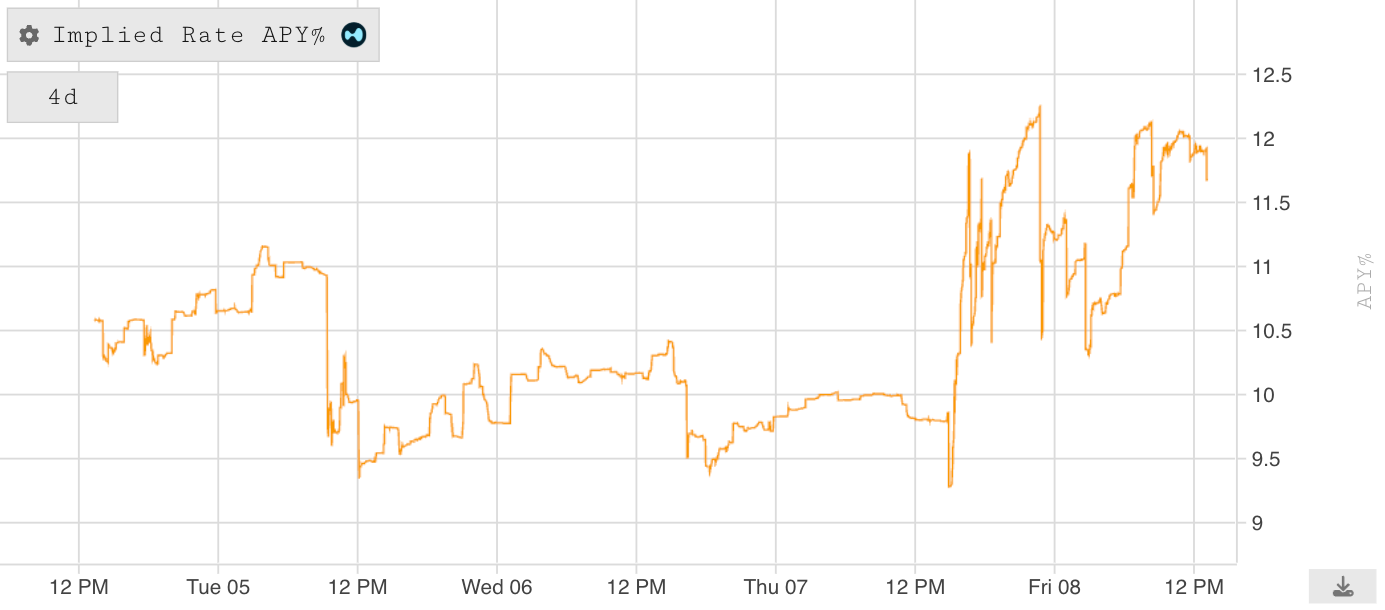

With over $160m kHYPE in the Pendle market, some larger whales seem to like the guaranteed yield the PT promises (sitting around 12% at the time of writing):

This market looks to be the perfect 2 way market, allowing Kinetiq bulls to speculate on the value of points and large HYPE holders to lock in yield. This drove this pool to be the highest daily volume pool at some point during the week.

POV the yield seeking HYPE whale vs YT-buying Kinetiq point bull:

For now it seems rates have found a floor around 9.5%, climbing rapidly over the last 24-48 hours or so:

It’s going to be very interesting to see who comes out on top in this Pendle market. We’ll be tracking the Pendle layout on Purrsec closely, monitor it for yourself here: https://purrsec.com/address/0x8867d2b7aDb8609c51810237EcC9A25A2F601B97