Parsec Weekly #129

the gpu backed dollar

the gpu backed dollar

Following last week’s dive into stablecoins, today I want to look at a newly launched project sitting at the intersection of stablecoins and RWA that’s caught my attention.

Most stablecoins and RWA-backed tokens draw from the same collateral pools and sources of yield. Unlike Ethena, which relies on derivatives markets, or Cap, which in effect aggregates DeFi strategies, usd.ai is betting on AI hardware as collateral — a fundamentally different source of yield.

The problem they identify is that, as it pertains to financing AI infrastructure, pools of traditional capital seem to fall into one of two buckets:

9 fig+ minimum deal size - the largest firms on wall street

zero willingness to lend - the average high street bank

This has created a financing gap for small to medium sized infrastructure operators. While they can often access trade financing from OEM’s to finance the initial GPU purchase, they struggle to access longer term debt for operations/growth via traditional financing methods.

Coreweave can tap capital markets for $7.5 billion in a single capital raise but a small sized operator might struggle to raise $20m. With regional and international banks unwilling to underwrite such infrastructure, many of these small to medium sized operators have been limited to expensive equity financing.

This is what usd.ai propose to solve; by connecting on chain capital to small to medium sized operators with a rigorous underwriting methodology.

In practice, usd.ai is implemented with a dual token model:

USDai = dollar-pegged, collateralized, liquid stablecoin

sUSDai = 15-25% yielding staked USDai wrapper which generates yield from: interest on loans made to GPU operators (GPU sale leaseback style arrangements), treasury yield on idle USDai, and redemption queue fees (QEV).

sUSDai relies on three key mechanisms: CALIBER, FiLo and QEV.

CALIBER

CALIBER is a smart legal-financial wrapper transforming GPUs into on-chain NFTs. Borrowers legally transfer ownership of hardware to a “Tokenizing Agent” then retain use via bailment. That NFT represents title, so if they default, it's automatically reclaimed by the lender. In theory it snips away courts and delays, bringing real collateral enforcement into DeFi.

FiLo

FiLo (First-Loss, Last-Out) is the underwriter layer that sits beneath depositor capital. Curators originate loans and post junior capital that absorbs defaults before sUSDai is touched. In exchange they earn higher yields and origination fees. It’s skin-in-the-game underwriting that lets depositor yield scale without compromising safety.

QEV

Redeeming sUSDai isn’t instant (because you can’t sell 100 GPUs overnight), so the protocol uses a redemption queue + auction system. If you need out fast, you bid to jump the line, generating extra yield that gets redistributed. It's liquidity on demand—with a risk-adjusted price tag.

Of course, the risks here aren’t trivial — GPUs depreciate fast, borrowers can default, and ultimately redemption liquidity is only as strong as GPU resale markets. The design (CALIBER, FiLo, QEV) is meant to mitigate that, but real-world risk doesn’t disappear.

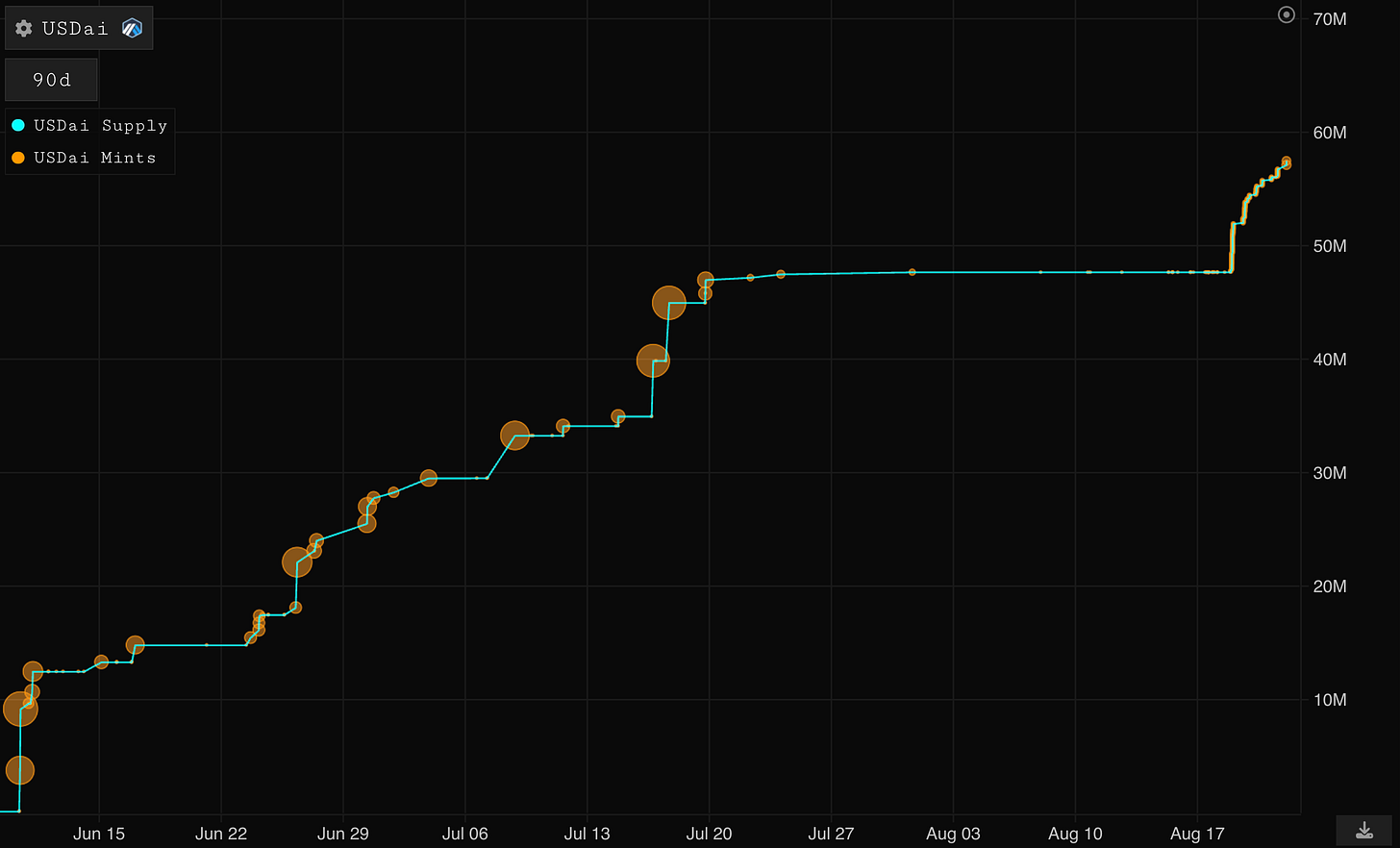

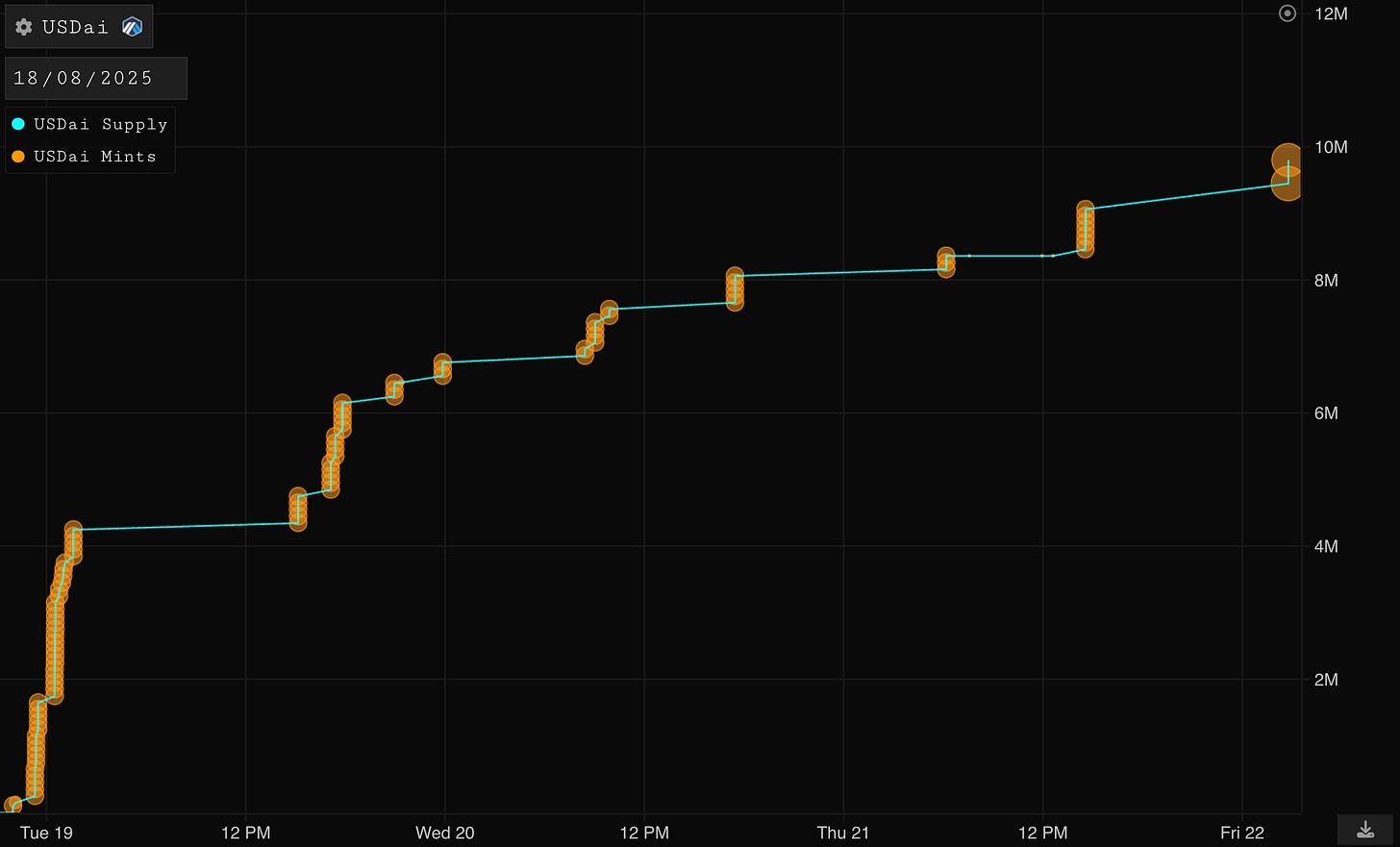

USDai mints are approaching 60m with 10m coming in since they opened up to public deposits on the 18th August. This has been helped along by the coincident announcement of their Allo program. Allo is an ICO<>Airdrop program which allocates points depending on how depositors interact with the protocol.

If AI is the new oil then usd.ai are certainly making a bold attempt at creating the AI petrodollar. Whether it is able to scale safely is yet to be seen but it’s certainly one of the more ambitious experiments in the stablecoin space right now and a project I will be keeping firm eyes on.