Parsec Weekly #144

DeFi meets Duration: Cork Protocol

DeFi meets Duration: Cork Protocol

Last week I wrote about Supernova and how their interest rate swaps might finally enable fixed-rate lending in DeFi. This week I want to stay on the same thread and explore another major gap in DeFi’s financial infrastructure.

We are increasingly seeing a broader set of tokenised assets moving onchain but the tooling to price, hedge, and trade the risk embedded in these assets hasn’t kept up. If DeFi wants to graduate from a playground into a legitimate financial system, it needs a risk layer. That’s what Cork is building.

The Risk Gap

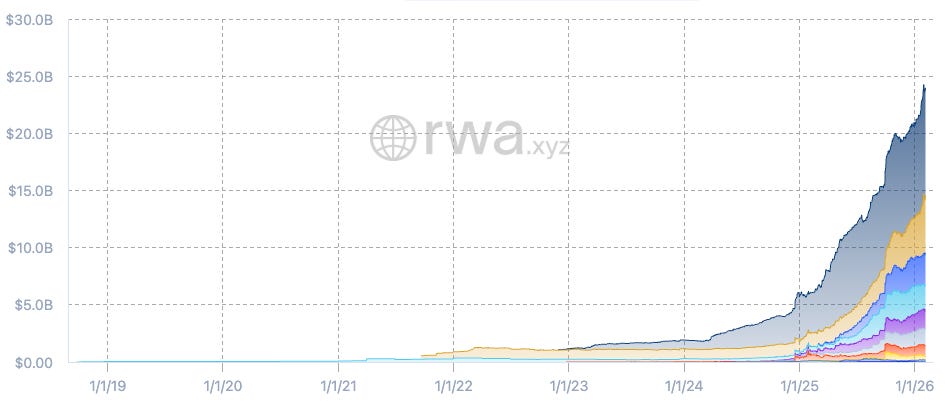

While still a drop in the ocean, tokenised assets (not including stablecoins) represent a growing market. As the market scales and the tokenised asset set grows broader, so too does the risk surface area.

Increasingly we are seeing tokenised private credit (Apollo’s sACRED, Midas/Fasanara’s mF-ONE) start to be used as collateral in DeFi money markets. Steakhouse Financial recently published an excellent deep dive on this trend. The core challenge is that for crypto-native collateral like cbBTC, DeFi repo works beautifully because DEX liquidity makes the collateral instantly liquidatable. For tokenised private credit, these guarantees break down as there is often no secondary liquidity onchain. Redemptions can often take weeks or months. This creates a massive duration mismatch between the on-demand nature of DeFi lending and the illiquidity inherent in private credit.

This isn’t hypothetical. In December 2025, Fasanara wrote down mF-ONE’s NAV by ~2% to reflect an updated valuation of the underlying private credit book. Steakhouse, who curate the Morpho vault exposed to mF-ONE, confirmed lenders were unaffected and that the LTV cushion and oracle discounting did their job. But the episode is instructive nonetheless; if the NAV can move against you and you can’t liquidate the collateral instantly, who’s holding the bag during that gap? For lenders used to instant liquidations, a mark-to-market adjustment on an illiquid asset with multi-week redemptions is a different beast entirely.

Cork Protocol

Cork is a programmable risk layer for onchain assets. The core primitive is the Swap Token; a tokenised derivative granting the holder the right to exchange a specified asset for a liquid collateral asset (like USDC) at pre-defined terms, at any time before expiry. Think of it as on-demand, pre-funded insurance for onchain assets.

Here’s how it works:

Every Cork market pairs a Reference Asset (e.g. a tokenised credit fund) with a Collateral Asset (e.g. USDC)

Collateral is deposited into a Cork Pool and split into two tokens:

Swap Token (cST): Allows you to swap your Reference Asset for the Collateral Asset on demand — the “protection” side

Principal Token (cPT): A residual claim on pool collateral at expiry — the “underwriting” side, you earn yield by absorbing risk

If the Reference Asset is impaired, illiquid, or depegs, the Swap Token holder can immediately swap it for liquid collateral. No withdrawal queues. No waiting for quarterly redemptions.

The beauty is that it’s pre-funded. The collateral backing the swap is already sitting in the pool before any claim occurs.

Phoenix, the Raise, and Earning Trust

Cork originally launched its public beta in March 2025 with Lido, EtherFi, Ethena, and Sky. In May 2025, the protocol was exploited for $12M through a vulnerability; four audits, formal verification and a bug bounty program had failed to catch the attack vector.

Rather than quietly disappearing, the team went through a comprehensive rebuild; significantly reducing smart contract complexity, migrating certain architecture to separate periphery contracts (following Morpho’s approach), introducing ERC-4626-style preview functions, and engaging ChainSecurity, Certora, Olympix and Hypernative across the full security stack. The team also published a formal security framework and, critically, all current and planned Cork markets are whitelisted — only vetted assets and counterparties can participate as they are targetting an institutional user base. Permissionless markets sit on the longer-term roadmap, but for now composability takes a back seat to controlled risk exposure. The result of the comprehensive rebuild is Cork Phoenix, which launched on Ethereum mainnet on January 19, 2026.

Shortly after, Cork announced a $5.5M seed round led by a16z CSX and Road Capital. One would expect a significant portion of these funds to go towards continued rigorous auditing and security hardening — exactly where it should be going for a protocol in this position.

That said, there is no shortcut to Lindyness. Cork will need to prove itself in the wild over time. A risk management protocol that suffered a $12M exploit has a higher bar to clear - time is the audit that matters most.

Use Cases

Cork’s use cases map neatly to the problems emerging across DeFi:

Protected Loops — The looping trade is one of DeFi’s most popular strategies but for tokenised RWAs with long redemption windows (30-90+ days), it carries enormous duration risk. Cork’s Swap Token provides an instant liquidity layer so that if the underlying RWA becomes illiquid or impaired, users can immediately swap for liquid collateral rather than waiting for issuer redemption.

Peg Stability — Stablecoin issuers can integrate Cork to offer their holders a mechanism to exit at or near par during stress events, enhancing user confidence and creating a market-based floor that can make depegs less frequent and less severe.

Duration Risk Management — Vault curators and bridge operators face their own duration mismatches. Both can leverage Cork pools as a composable liquidity buffer to support smooth redemptions during volatile conditions.

Cork’s integration with AggLayer’s Vault Bridge is an early example of this use case. The Vault Bridge rehypothecates bridged assets into Morpho vaults for yield, but at ~90% utilisation only ~10% of collateral is available for immediate withdrawal. Cork sits underneath as a pre-funded liquidity buffer so that users on chains like Katana can always redeem instantly while LPs earn a premium for guaranteeing that liquidity. Same pre-funded buffer, applied to bridge redemption risk rather than credit risk.

Institutional Liquidity Buffer — This connects directly to the Steakhouse thesis. If a risk curator is onboarding tokenised private credit to Morpho, Cork can sit alongside the lending market as a composable liquidity buffer to mitigate the duration mismatch for DeFi lenders.

The Bigger Picture

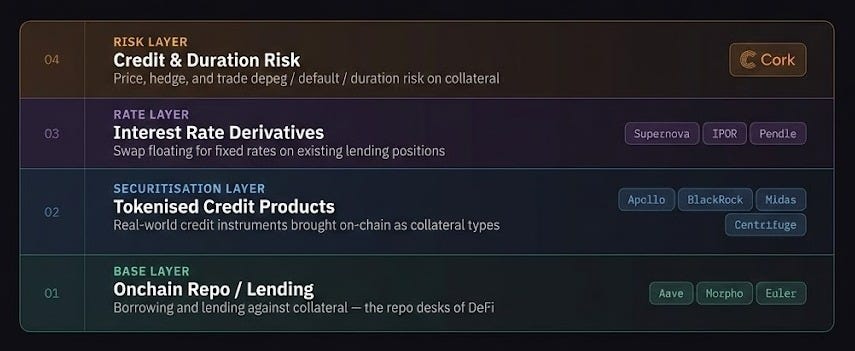

If you zoom out and look at the infrastructure stack being assembled right now, the outlines of a real financial market are forming onchain:

Base Layer: Lending markets (Aave, Morpho, Euler) as repo desks

Securitisation Layer: Apollo, BlackRock, Midas/Fasanara tokenising credit products as on-chain collateral

Rate Layer: protocols like Supernova enabling interest rate swaps for fixed-rate exposure on top of variable-rate positions

Risk Layer: Cork providing the ability to price, hedge, and trade credit/duration/depeg risk

In traditional finance, these layers have existed for decades. What’s happening in DeFi is a re-derivation of the same financial stack with programmable, composable, transparent primitives rather than bilateral OTC agreements. With protocols like Supernova and Cork sitting on top of Morpho and other repo market infrastructure, you get something that starts to look like a functioning onchain credit derivatives market.

My Take

Cork is tackling a genuinely important problem. The gap between the assets moving onchain and the risk infrastructure for those assets is real and widening. As a broader set of tokenised RWAs and structured credit comes onchain, something like Cork becomes increasingly necessary.

Whether they can earn back trust after the exploit and build sufficient liquidity depth before the next stress event are the key questions.

What I’m watching:

Partnerships with asset issuers, risk curators or vault deployers for Cork Phoenix

AggLayer Vault Bridge performance during stress

Security track record over time