Levelling up on chain UX

-kezfourtwez

Over the last few months a new trend has formed off the back of Unibot’s success. An armada of shitcoin tooling has been released as devs try to capitalise and be the shovels in the shitcoin goldrush. That sounds kind of cynical though, many of these tools are super helpful and I’m a big believer that some will help to reshape the way that traders interact on chain.

In case you’re unaware, Unibot lets you easily set up wallets and start trading coins through telegram. Unibot X is their all in one web app. The advantage is a massive increase in exploration, vetting, execution and all round efficiency. The trade off is that you give up access to your private keys, the teams behind these tools use all sorts of measures and encryptions to make it safer for the user, but at the end of the day your keys are sitting on a server somewhere.

Have you tried to use Uniswap lately to trade coins in high stakes conditions? They recently implemented a double sign security feature, you used to only need to approve a token for trading once, now you need to approve, sign a 2nd message to confirm and to top it off they ask you to resign this message on random short intervals. This is a massive hindrance when you’re watching the chart with one eye and hovering over the red button with the other, half the time you end up needing to refresh and re set up your amounts and trade direction because of a bug that stonewalls you from even getting to the wallet pop up.

This probably sounds trivial to most of you, but I can assure you that in the heat of the moment it’s a huge disadvantage wasting those precious seconds, which is a good segue into the UX improvements. These bots currently do two things really well, that benefit two very different demographics:

Strip away unnecessary steps to give a better UX and execution time to shitcoin flippers

Chip away at the cumbersome onboarding process for newcomers to begin buying coins on chain

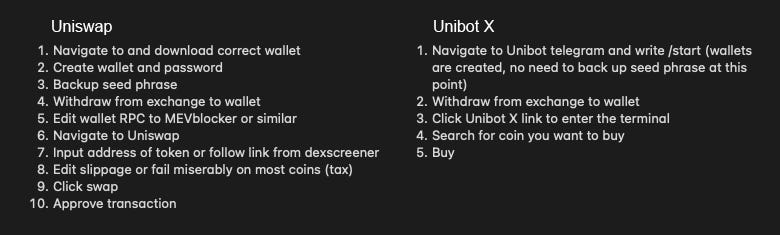

Here’s a comparison that shows how much easier it makes it for both of the above parties:

One day come greener bull market pastures, an app like Unibot may help to onboard the masses. As for the on chain degenerates currently still kicking it in the trenches, these bots save vital seconds when trading that can mean the difference of thousands of dollars.

I’ve used a variety of these tools now, there’s two categories that stand out to me and I think there is room for both.

Telegram trading bots/Unibot X and Discord trading bots. The edge of the former as I’ve already mentioned is speed in execution. When you are pasting a contract address and clicking through the menu options on tg, the buttons change according to your clicks at lightning speed and your buy order can be sent and confirmed in a couple of seconds when gas is low. Discord bots on the other hand are inherently slower due Discord’s architecture. You can be waiting 2 - 5 seconds while the bot is ‘thinking’ before it even broadcasts your transaction. But they have another advantage, Discord is a whole new market demographic which in my opinion are generally less serious traders and more NFTwitter aligned. The bot I’m referring to is called None bot, and it also has a social aspect. Before I switched over to Unibot I was using None with my friends in a private channel. You can be having a regular conversation, whilst someone sends a contract address and you can all buy directly from the modal, its collaborative nature is a lot of fun.

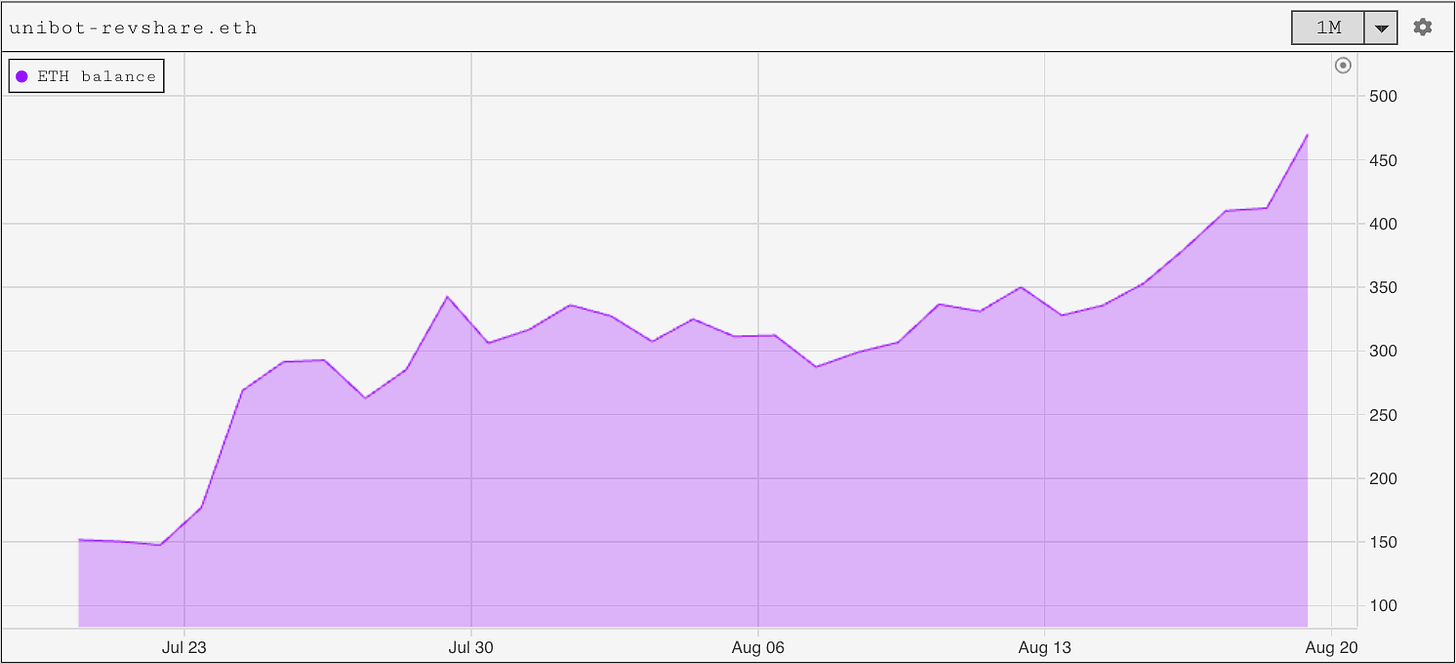

The last thing I want to mention is a big part of why these bots, and especially Unibot was so successful in bootstrapping users. The answer is aligned incentives through revenue sharing and referral links. Unibot currently sits at $180m market cap with 6000 holders and 2000 daily users. Pretty impressive stats for the market conditions. Holders earn a proportional share of revenue generated from the token tax and bot fees. Users can also generate a referral link and get a share in all the fees that their referred users generate. Both of these massively contributed to the early growth of users and holders. Revshare works on a claim basis, there is currently 470e waiting to be claimed, and they have paid out 2000e to date. A pretty tasty incentive for early adopters with an audience!

The battle of the CEX-backed L2s

-chulie

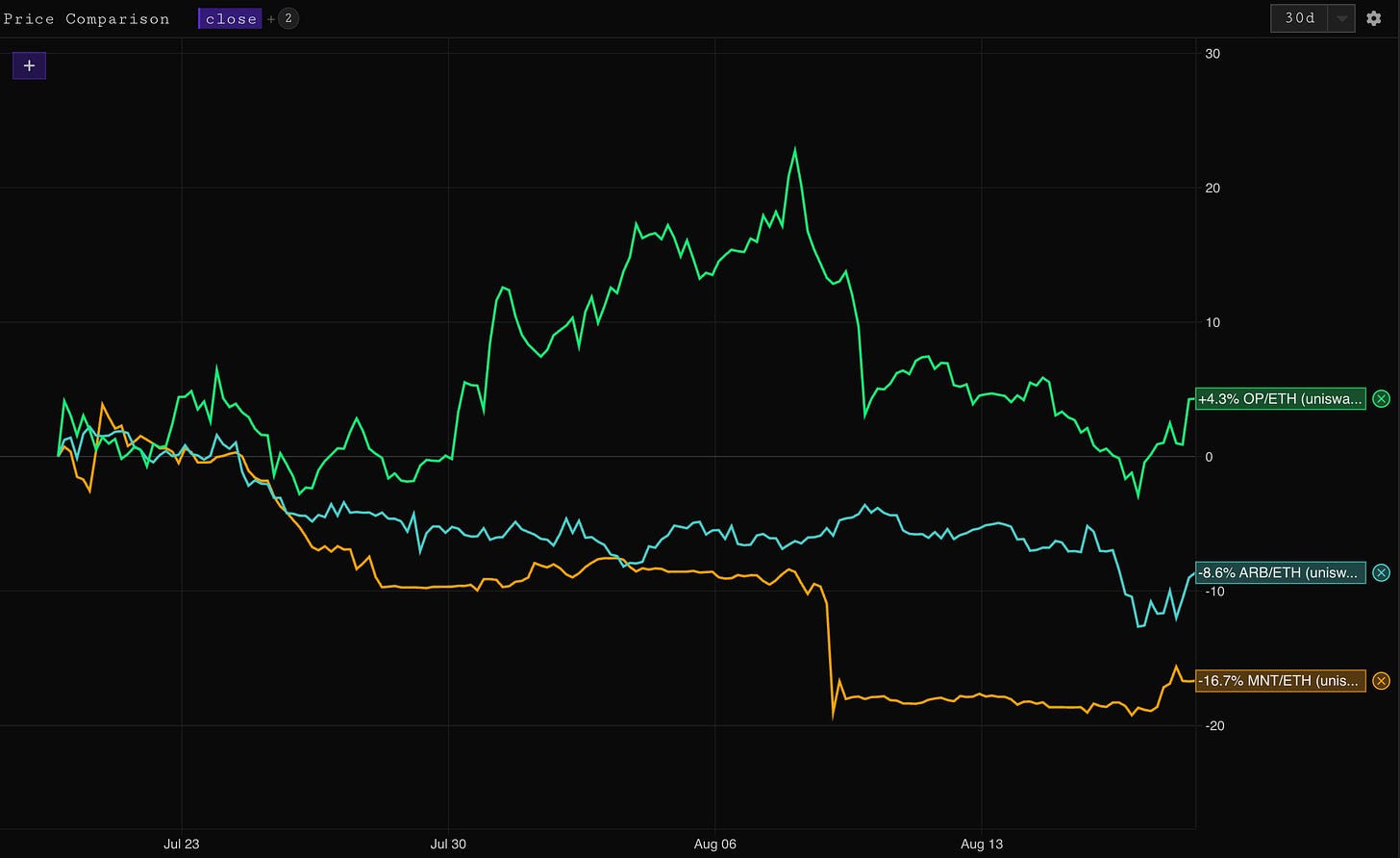

A couple of weeks back we wrote about the relative performance of L2 coins and the drivers of their performance. Since then we have seen the successful launch of Base (Coinbase L2) and continued OP strength while MNT lagged both both in price performance and market traction following its mainnet launch and token conversion:

With just ~$38m in TVL, Mantle has struggled to attract the TVL and activity which many were expecting following a relatively hyped mainnet launch. Despite having a head start, it is fair to say Mantle has been outshadowed by the successful launch of Base.

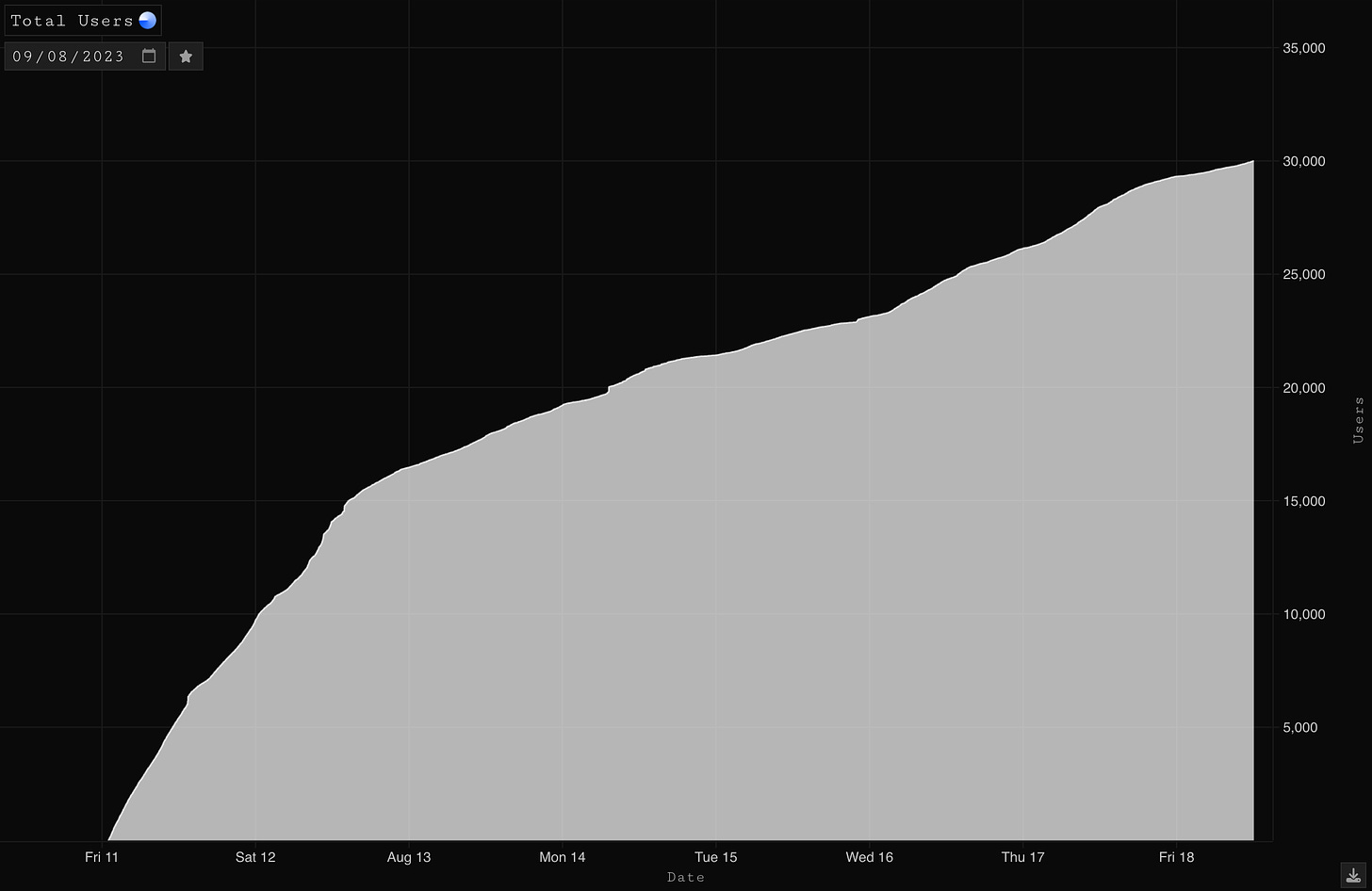

Base launched on mainnet on August 9th and has since accrued ~$162m in TVL. With bluechip DeFi yet to be onboarded, the DeFi ecosystem is relatively immature with the early innings being dominated by meme/shitcoin trading - reminding us of the early Arbitrum days. Contrary to some commentators we actually see this activity as a positive sign for Base as on chain degens vote with their wallets. Alongside Coinbase’s Onchain Summer campaign, the most positive development for Base has been the launch of friend.tech which we discussed at length in last week’s edition. The social app has garnered over 30k users since launch:

With the launch of opBNB (an OP stack L2 on BSC), competition between CEX-backed L2s further intensifies as they compete for attention, capital and developer mindshare. For now Base looks to be winning the battle and we’ll be on the look out for more interesting launches similar to friend.tech. The continued success of Base can certainly be seen as a positive for OP given the sequencer revenue share agreement but ultimately it is more constructive for Coinbase equity holders.

ok

Nice project