On chain shenanigans

gm loyal keyholders, another week with a whole lot of not much going on aside from Friend Tech, so I’ll do a little overview of where we’re at with it.

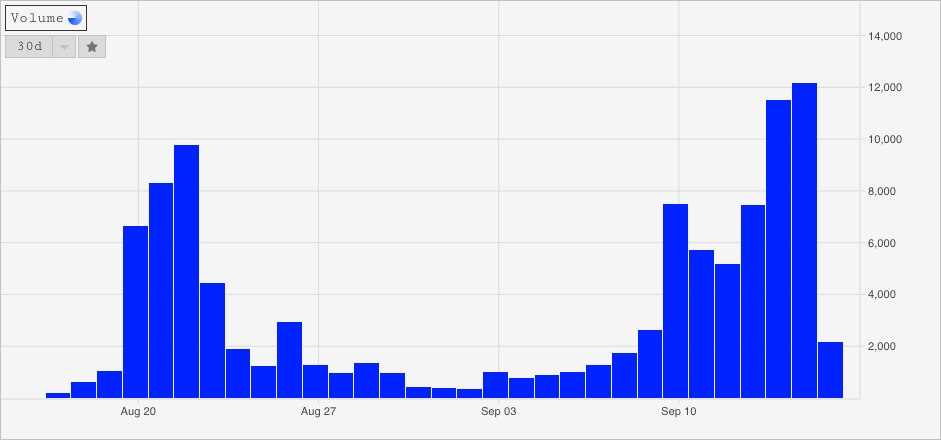

Friend Tech had its biggest week yet for volume, 53,800e has traded through the platform in the last 7 days. Yesterday was the biggest day for volume so far at 12,200e. This translates to very healthy revenue for both creators and the team at over 2500e each this week. Millions are being passed onto creators on a good week, it’s not hard to see why it’s so attractive.

Signups reached a peak of 750 per hour yesterday, and total signups now sits at 177k. Worth noting that there are a large number of fake accounts joining to bait both snipers and manual users, so it does beg the question what percentage of that is real, and what percentage of that are using the app every day.

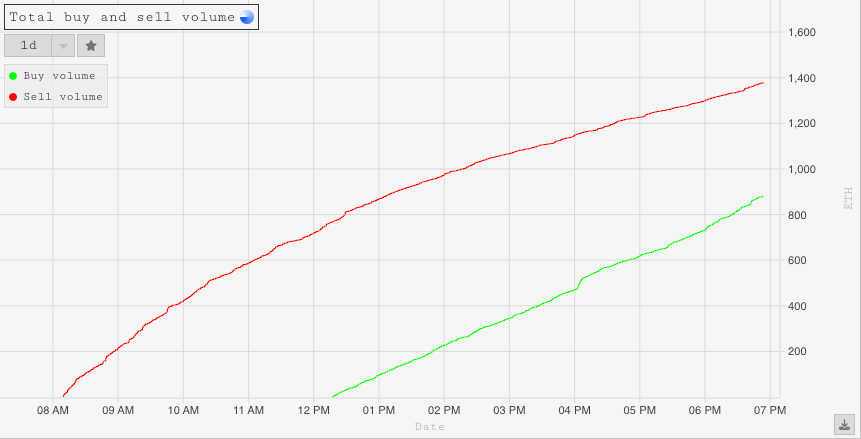

In the last 2 days there’s been quite the sell off, evident in the chart below. It’s been a common occurence heading into the weekly points distribution, but there doesn’t seem to be much of a rhyme or reason to who’s selling off and why.

Most of the top 10 by price are only down 10-20% from the top whereas the mid level accounts have experienced larger sell offs. The reasoning behind that could be that users feel parking ETH in the high value stuff is a safe farm, where the bonding curve and fees greatly incentivise holding.

Racer easily has the best performing chart and is a great example of this. Pretty much up only all the way to 8.9e. These fee bands illustrate the real buy and sell price of a key, currently it costs 9.87e including fees to buy Racer, and if you were to immediately sell you’d only get back 8.09e

After experiencing another high in volume, key prices and activity. If history repeats we could have another couple of down weeks to the point where people start calling it dead and saying ‘I told you so’. But personally I don’t think that’s going to happen, I think FT has reached the velocity where any meaningful dips on high value keys will be bought up and used to farm points.

The bigger Friend Tech gets and the more mindshare it occupies, the further spheres it will penetrate, and the higher the expectations of a big airdrop and high value token. Basically the larger it gets, the more self fulfilling and resilient it becomes.

The great R repeg

Raft.fi is a CDP protocol allowing users to borrow a native stablecoin (R) against a range of ETH collateral options (spanning all of the popular LSDs and WETH). While TVL is down significantly from its peak (currently ~$36m down from ~$65m), there have been some interesting recent developments which may act as a prelude to a GHO repeg and consequent yield opportunities on stables.

With extremely low initial borrowing costs (0.5% fixed fee to generate R) and no real use case other than providing liquidity, the stablecoin almost immediately traded below peg:

Recognising that this would limit trust and growth prospects alike, the Raft team have iterated with a v2 of the product. Their efforts have largely been successful with R now trading just ~$0.004 below peg as shown above.

The approach has been 3-pronged with the introduction of a pretty standard Peg Stability Module (or PSM), Interest Rate Vaults and most interestingly an R Savings Rate.

As for the PSM, in the case of sub $1 R, arbitrageurs can buy R at market and redeem it for $1 of USDC, DAI or sDAI - effectively reducing the supply of R. Alternatively in the case of $1+ R, the PSM can mint R and sell it at market for USDC, DAI or sDAI, thereby expanding the supply of R.

The Interest Rate Vaults bring R borrow rates closer to market rates and reduce the attractiveness of looping which was pressuring the R peg. Loopers would supply wstETH, borrow R, sell R into wstETH and repeat as a much cheaper way to lever wstETH compared to other venues.

Finally, the R Savings Rate introduces a native yield for R and more importantly a reason for borrowers to hold R rather than selling. As shown in the above schema, this rate is generated from protocol fees (borrowing, flash mints and liquidations) and sDAI yield generated by the protocol reserve yield pool. By offering an 8% yield on R deposited into the R Savings Rate, it is no surprise that we’ve seen a relatively strong uptake in just a matter of days:

While Raft and R are currently operating on quite a small scale, it is interesting to see their v2 iterations lead to a successful repeg. We would expect to see a similar scenario play out with $GHO as the Aave DAO looks to implement a similar set of measures. This is something we are watching closely as it would unlock a plethora of carry strategies which are currently not so attractive given the price of $GHO (I discuss this here).

The project is implemented professionally and has a clear development plan. Made by a very professional and experienced team. Without doubt, this is on e of the best project

Well