Prisma Finance - the new kid on the block

Prisma Finance is one of the newer CDP protocols built on top of the Liquity codebase allowing users to deposit ETH liquid staking derivatives as collateral and mint mkUSD on an overcollateralised basis against it. In this sense it is similar to the plethora of other projects which have launched with a similar value proposition post Shanghai (read: Lybra, Raft, Gravita). For a deeper understanding of the underlying protocol mechanics, check out this explainer article from our friends at ASXN.

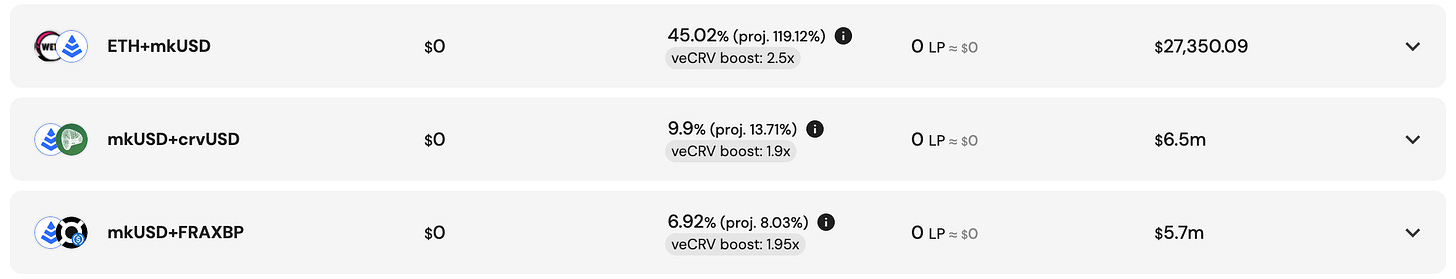

Prisma’s key differentiation vs the competitors listed above is its close ties to the Curve ecosystem. The project backers include Mich (Curve Founder), the Convex founders, FRAX Finance, Conic Finance and more. This positions Prisma well to benefit from incentivised liquidity on Curve and Convex whereby LPs will receive CRV and CVX emissions alongside trading fees. Unsurprisingly, these pools have been the beneficiaries of significant veCRV gauge voting, making for some relatively attractive yields:

With the recent Curve drama (which we discussed here), the launch timing has been rather unfortunate for Prisma as higher CRV prices would have made their value proposition look much better (higher yields for LPs = higher demand to mint mkUSD). Despite the unfortunate Curve situation, mkUSD minting caps have still been maxed out hitting their respective limits across all markets:

While the limits are small with a current total system debt capped at $30m, the fact that these have been met is a positive sign. We can likely attribute this to Prisma’s points program. In keeping with a popular trend from projects to incentivise usage of their product, Prisma’s points program is a “new way to reward the contributions of users during the Prisma guarded launch”. Their program measures the on-chain contributions of early users with points being primarily rewarded to users opening vaults and minting mkUSD. Once again the allure of an airdrop acts as a carrot on a stick for Crypto market participants!

Pudgy’s go mainstream

-kezfourtwez

18 months ago Luca Netz spent $2.5m of his own money to buy out a dying NFT project wrought with controversy. This week, toys from that NFT project found themselves in 2000 stores across the US belonging to the highest grossing retailer in the world, Walmart. Luca has absolutely put the projects that raised eight figures to shame.

Each one of the toys is licensed directly from the holder of the NFT counterpart and they receive royalties on every sale in perpetuity. Aside from their success in the physical world, it feels like Pudgy’s are the last man standing out of a basket of once great digital assets. The only project to not massively screw over their holders at one point or another.

Over the last six months they are the only collection out of that basket that has appreciated in price, every other is down more than 60%. The above chart says it all.

Pudgy’s price had already been been performing well pre-announcement, with a 10% move on Walmart day.

your team working hard for best output

Great project