Bot wars

-kezfourtwez

Since the launch of Unibot we’ve seen a slew of similar tooling come out and the tech get increasingly better as the landscape becomes more competitive. Maestro’s telegram bot was the first mover releasing in June of 2022, but the stars aligned when Unibot released their token along with revenue share in May of this year. The market conditions were ripe for reflexivity as onchain volume went parabolic off the back of $PEPE’s meteoric rise to a $1.5b FDV in just 21 days. The rise in volume as Unibot gained marketshare drove massive amounts of revenue back to early adopters wallets, further fuelling a thriving onchain landscape. To date, Unibot has paid out over $8m to token holders.

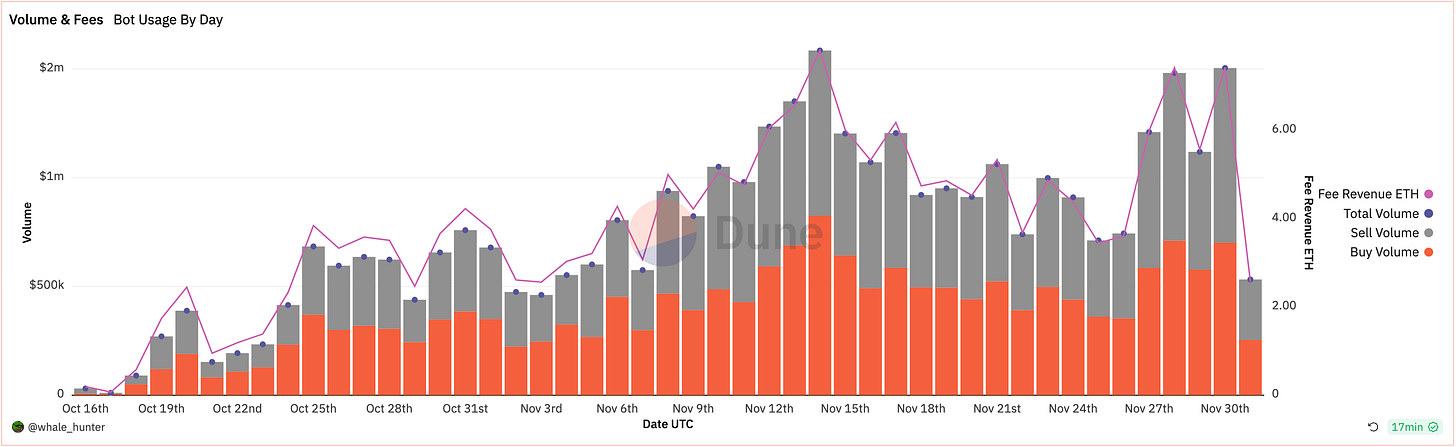

Of the more successful new bots to roll out, we’ve also had Banangun and more recently Shuriken. Bananagun came on the scene not long after Unibot in June, but was laying low with minimal mindshare until word of the token got out. Since then it has been steadily gaining in volume, fees and users, reaching a high of $18m in daily volume just a few days ago. Quite a large figure when you consider the available liquidity for the coins that are being traded, yet it is still less than half of Maestro’s top volume day at $48m back in May.

Maestro is still the market leader but interestingly has no token or plans for one as far as we know. It may seem like a disadvantage when you look at the parabolic growth of Unibot and Bananagun post-token launch, but it’s easy to be content when you are sitting on over $30m of fees.

To date Maestro has facilitated $3.1b in volume in its nearly 18 months of being live. The point I’m trying to make is that the trading bot sector, the volume it has generated and the QoL improvement for users are meaningful and real. Whether a feature or a bug, I think the market is yet to price in the further billions that this sector will do in volume, and hundreds of millions in fees over the next couple of years. Especially when you consider that a large majority of their uptime has been in a bear market.

Total sector stats of the top three bots as per Whalehunter’s dune dashboard’s:

$4.327b in volume

303,484 cumulative users

30,596e ($64m) in total fees

All of that equates to a measly $231m in combined token market cap across the entire bot sector (FREE), consisting of 15 products with 8 tokens. Based on those fees alone it’s not outlandish to predict a sector market cap of billions in the next few years.

So the question is how do you position yourself for that? You can probably just buy whatever you think is the strongest product with the best outlook, and expect solid multiples in that timeframe. But in my opinion, quite simply start using the good products with no tokens. Crypto has proven time and time again that you don’t need money to make money if you’re patient, early Bananagun users received around 15e in tokens on launch.

This is where Shuriken comes in - Shuriken is the fastest growing trading bot in volume and fees behind Bananagun. Marketshare by users currently stands at 8% and it’s overtaken Unibot in volume and fees in just six weeks.

It’s objectively the best positioned to capitalise on the future growth of the sector and a token is confirmed. In fact they have a full on rewards leaderboard with trading quests used to accumulate shuriken stars. Not only that, but the team has spent the last two years proving themselves as competent builders that deliver with NFTsensei, a widely used subscription based NFT bot.

I’m biased as I almost exclusively trade onchain and love these products, but regardless of your favourite crypto playground, the data suggests that the trading bot sector is poised for growth in 2024 and beyond.

If you want to try Shuriken out feel free to use my referral link

AAVE’s efforts to repeg GHO

Back in August, we discussed the launch and subsequent depeg of GHO, AAVE’s new native CDP stablecoin. We noted that a below market interest rate, lack of utility and no Peg Stability Module were all likely causes and future contributors to a sub $1 GHO. Having spent most of its short life trading below peg, there are signs of reversal afoot…

This budding reversal has largely been the result of governance actions which directly address some of the issues listed above. For example, a recent proposal to introduce an incentivised GHO Safety Module has passed. By providing a 12-15% APR on $9m of liquidity, market participants are incentivised to buy GHO and stake it in the safety module to earn AAVE - providing utility and buy pressure for the stablecoin.

The second important proposal we have seen as of late addresses the interest rate question. Recognising that a below market interest rate places pressure on the GHO peg, a proposal penned by Marc Zeller proposes an increase in the borrow rate to 5.22% which is more in line with market rates. The proposal also outlines a dynamic rate policy which would raise rates by 100 basis points up to 9.5% every week until GHO reaches a monthly average price of 0.995-1.005.

The combination of these two drivers has led to the recent rally in the price of GHO and will likely contribute to an eventual full repeg. Achieving stability in stablecoin price is essential for any stablecoin provider as it drives confidence and therefore increases usage. While the recent price increase has not led to a coincident increase in GHO borrows, we would expect an increase in borrow volume as the stablecoin repegs and borrowers no longer have the repayment risk of their GHO-denominated borrow increasing in $ terms.

An increase in GHO borrow volumes leads to an increase in revenues to the AAVE DAO. This is especially interesting given recent decreases in AAVE emissions along with murmurs about directing protocol revenues in GHO and ETH to AAVE stakers in 2024:

With AAVE curling around the key meme level of $100.00, 2024 is shaping up to be an exciting year for the Crypto bank…

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!

Interesting! I need to take a closer look at these trading bots.

Interesting