Aerodrome

The first time we wrote about Aerodrome was about a year ago (read it here) when the Velodrome team launched Aerodrome on Base. We discussed the Solidly model and how UniV3 was still dominating DEX volumes, the picture has changed somewhat in these past 12 months.

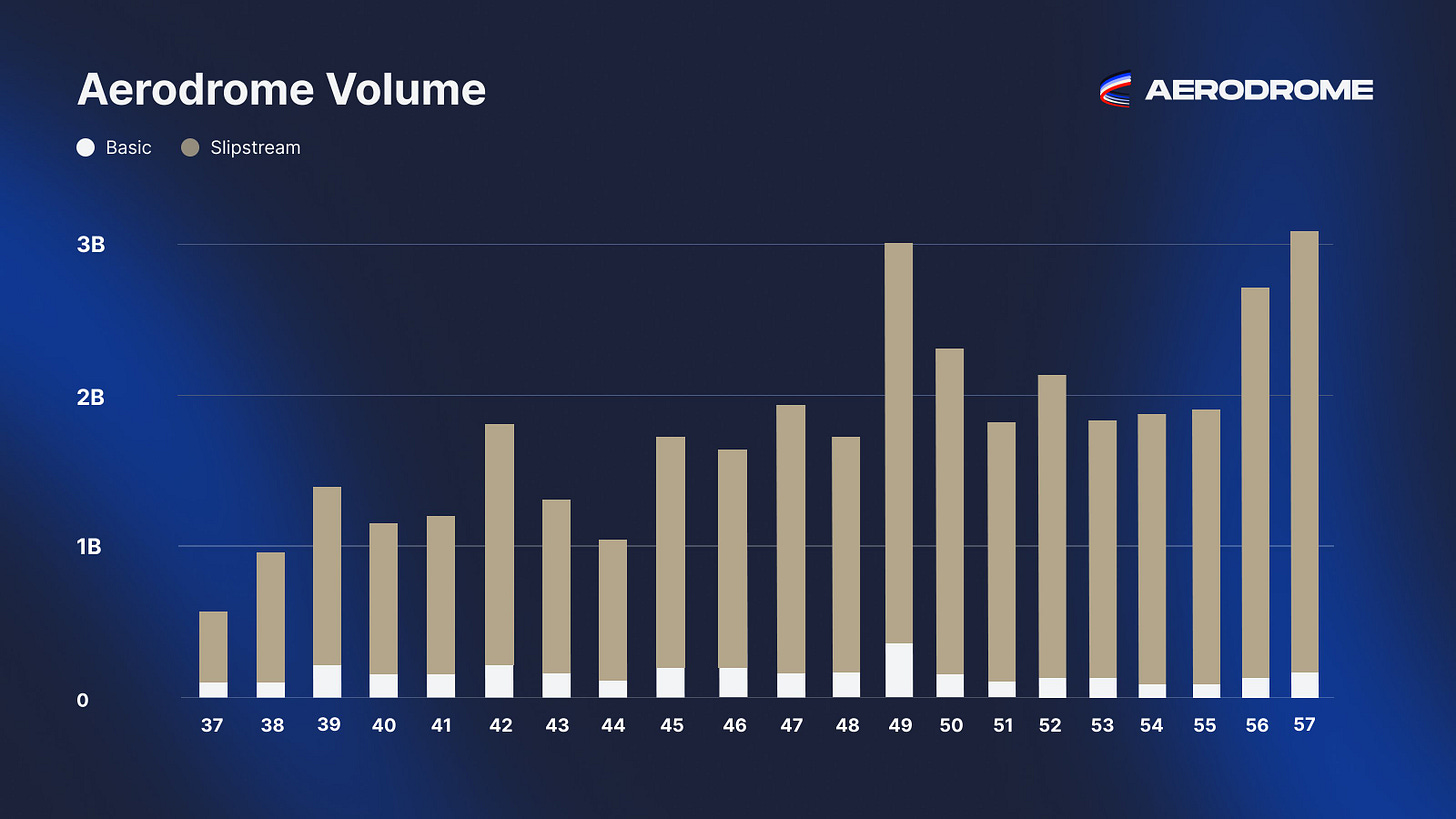

Fast forward and Aerodrome is now dominating volumes on Base:

With over $1bn between V1 and Slipstream, Aerodrome is the largest protocol by TVL on Base and represents over 50% of their total TVL! The introduction of Slipstream (concentrated liquidity on Aerodrome) has been largely to thank for Aerodrome’s recent success with Slipstream pools dominating volumes:

Underneath the hood, it seems as though cbBTC is driving the lions share of volume on Slipstream:

Given the Solidly model used by Aerodrome, 100% of trading fees are directed towards veAERO voters who have been eating good with the resurgence of volume we have seen. Unsurprisingly we have seen a resurgence of AERO price in reaction to this:

AERO is emerging as the “Pick-and-Shovel Play” on Base, the project and the coin which could benefit most from the growth of cbBTC and the return of speculative activity on Base too.

Unsurprisingly, with the success Aerodrome has seen as of late, it has not been all smooth sailing with Andre Cronje (the original pioneer of the Solidly model) expressing disgust at the way the team seem to have licensed originally open source code for commercial ends... :

-kezfourtwez

gm crypto market enthusiasts, we are officially in Uptober and it is off to a rocky start. September being historically one of the worst performing months has this year gone against the grain, with BTC finishing 7.3% up. We fought against seasonality and crypto conferences to end the month green, only to get hit with war uncertainty and weak Bitcoin price action at the $66k higher high, resulting in nearly a 10% tumble in just three days.

A few points to add to Charlie’s above;

Base’s TVL has nearly 10x’d to over $2b since our newsletter from last September when it was relatively fresh off the press. An impressive feat on its own, but even more impressive is that Aerodrome pools make up half of that, strong growth and retention metrics from them this past year whilst also providing real financial opportunities to their LP’s.

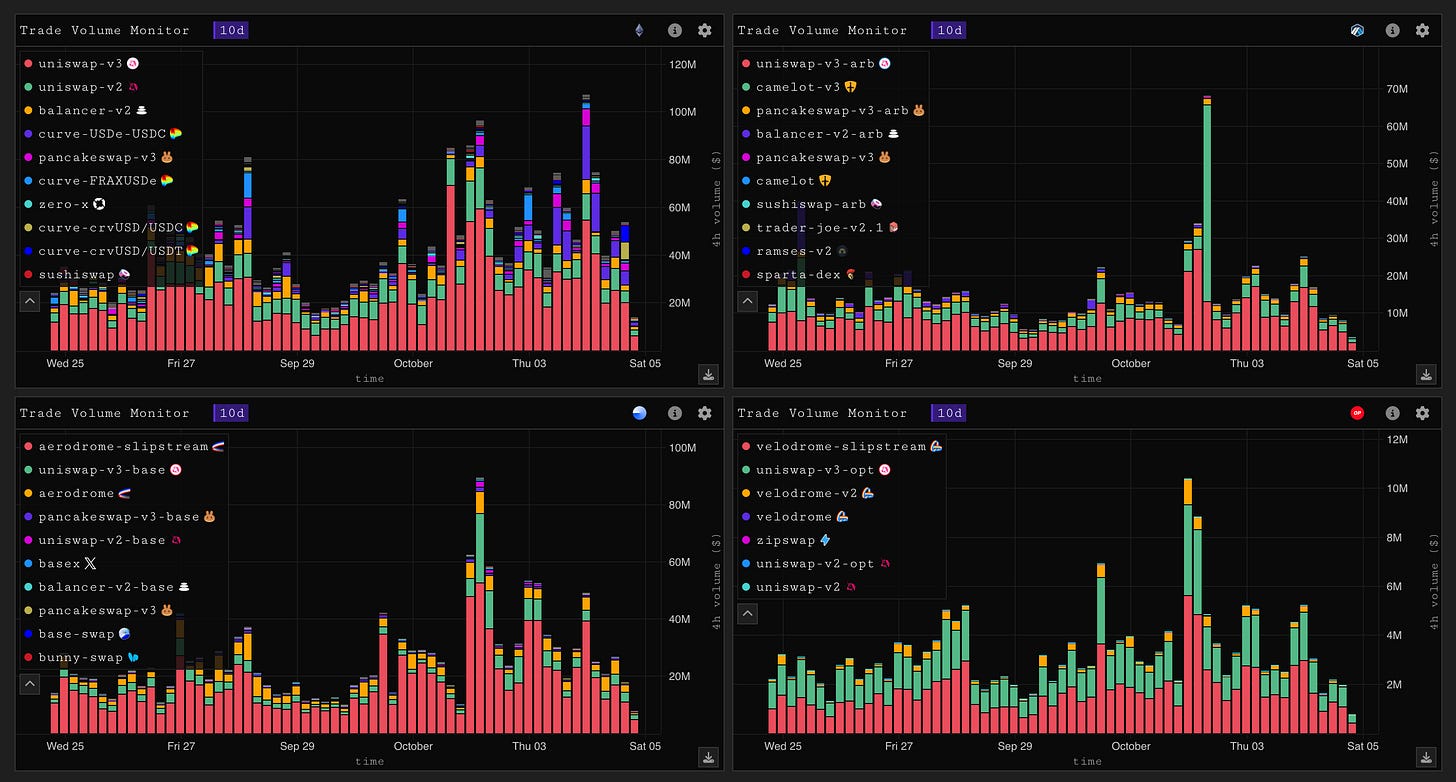

Yesterday the highest volume pool across all chains was the ETH/USDC Slipstream pool at $289m, this translates to $115k of fees to LP’s which at 4bps is 232% APR.

If we compare the top four EVM chains by volume (Ethereum, Base, Arbitrum & Optimism), Uniswap dominates Ethereum and Arbitrum while Aerodrome/Velodrome dominate Base and Optimism. An interesting observation here is that it does always seem to be ‘domination’ over equal share. Either way, between the volume and the revenue<>fees flywheel Aero/Velo feel poised to continue their marketshare growth.

Trenches

A general note on the vibe in the trenches, I like to think that shitcoin metrics are a pretty good temperature gauge of general risk appetite. The last couple of weeks it has felt like easy mode may be back, or at least easing in. Coins regularly break their prior months $1-2m caps, we’ve had multiple daily runners to $5-10m, strong established coins running $50m-100m and coins like SPX6900 and MOODENG running to low nine figures.

A few months ago I tweeted my thoughts on the dispersion in shitcoins and how the daily sums of money being pulled out through infra provider fees felt unsustainable. It feels like that period is over and nature is healing. There is optimism in the air and like I said above, the ceiling on coins has once again been lifted.

Now whether this a sign of premature front running into rate cuts and election season is the million dollar question. But for now I choose to enjoy and read it as a good sign.

Hyperliquid

The snapshot for the final points distribution was on Tuesday this week, with the actual distribution taking place just an hour or two after this will be posted.

There’s still a lot of unknowns due to a very diligent and tightlipped team that seem to making every right move. The announcements, updates and platform/node upgrades seem to be coming in hotter than usual, and with the conclusion of points it feels like this is for good reason, I think news is imminent.

The end of HL points opens the door to much, but there are three near term things that I’m think about:

We finally get to see how much volume is mercenary capital (<20% imo)

PURR’s price is finally untethered from farmers

We should soon get to see the result of the May secret season points

The first two may take a few weeks to play out, I think the general ecosystem participants need a little more certainty from the team surrounding TGE and EVM launch dates before we find equilibrium.

Something I really like about the way the team have rolled everything out; As a result of taking no funding and building an organic cult-like community, they have cultivated real demand to build on the EVM. As a result they are in a position of power, the community have already built all sorts of awesome tools for them for free and there are plenty more larger scale projects building on testnet and raising capital.

This creates a natural selection dynamic where the team doesn’t need to endorse any one canonical version of anything. They can let the organic demand dictate this, whilst helping to guide the ecosystem in the direction they think it should go. Like a parent helping to gently prop up their child on their first bike ride. Add builder codes into the equation to further help incentivise quality, and they are incredibly well set up for success.