Parsec Weekly #131

USD.AI

USD.AI

A couple of weeks ago, on the week of their public launch, I wrote about USD.AI. If you haven’t read that one, go back and read it here before reading this. Today I want to discuss some interesting developments which have transpired over the last 2-3 weeks while the initial article goes deeper into protocol itself and the market opportunity they are addressing.

Loan issuance ramping up

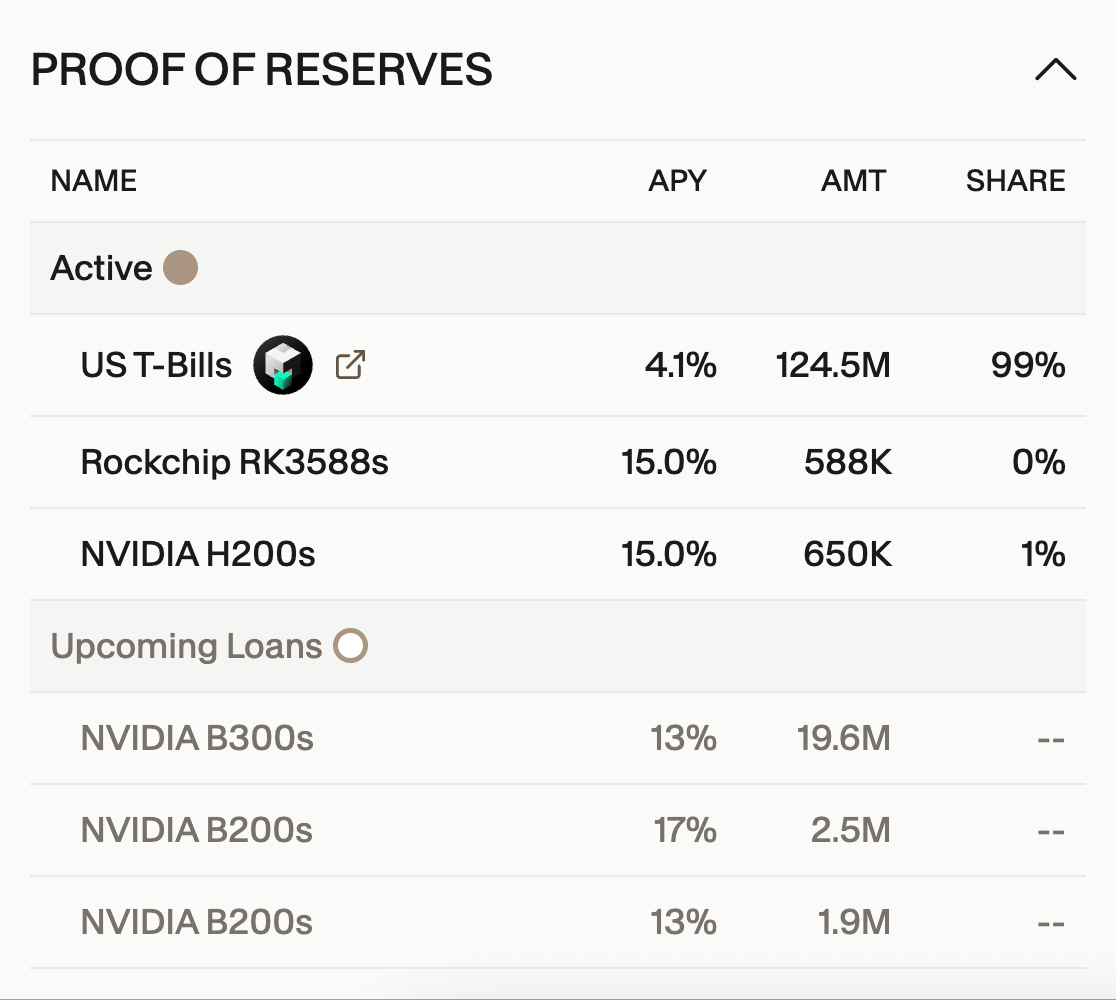

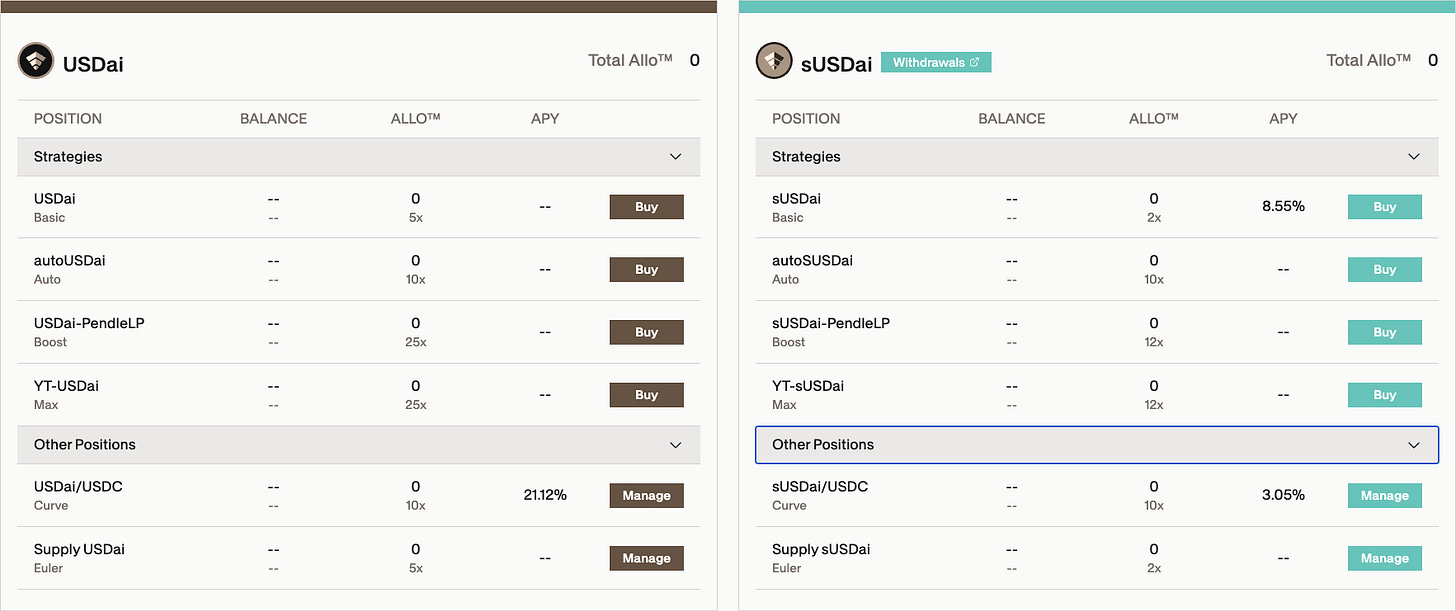

With such a large amount of TVL flowing into the protocol over the last couple of weeks, the majority of this capital is sitting in T-Bills for now. However, it seems as though the loan issuance machine is in motion with some larger loans coming online in due course with some healthy looking APYs inbound for stakers:

Given the apparently high demand to engage with USD.AI and participate in their “Allo” (dual ICO<>Airdrop) campaign, it is likely that we will continue to see TVL growth outpace growth in loan issuance meaning that risk should remain relatively low for sUSDai in the near term. At some point (perhaps if/when team stop raising caps) I would expect this to even out as TVL growth slows and loan issuance picks up, thereby increasing yield paid to sUSDai but also risk to stakers (increase in redemption times + increase in credit risk).

Pendle markets live for USDai and sUSDai

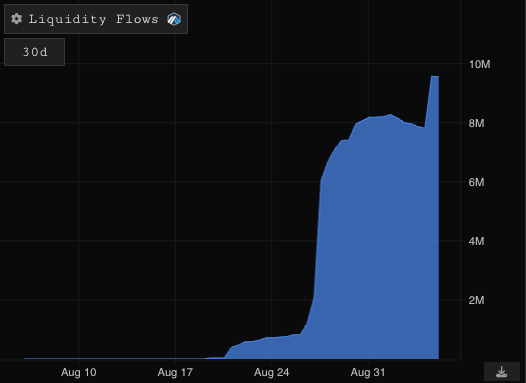

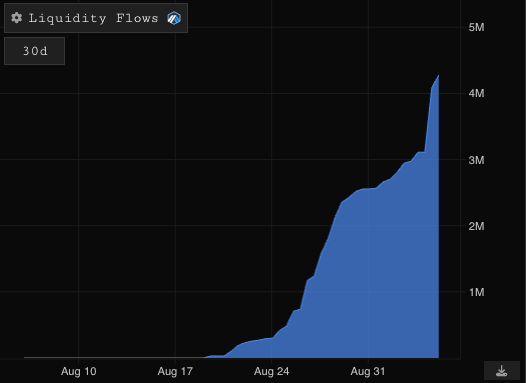

DeFi integrations were still TBD when I wrote the initial piece but we have since seen a raft of integrations including Pendle which has seen a lot of interest on both the USDai and sUSDai markets:

Interestingly, participating in these Pendle markets offers points multipliers for their “Allo” campaign with the multiplier depending on the interaction a user makes:

Buying the YT of either the USDai or sUSDai market offers the best dollar for dollar pure play on either the ICO aligned USDai track or the Airdrop aligned sUSDai track (with 25x Allo multipliers respectively). This dynamic is likely juicing the yield, which is sitting in excess of 20% for both markets:

Binance Labs

Following the public launch we’ve seen YZiLabs (prev. Binance Labs) make a “strategic investment”. While such an investment far from guarantees a Binance listing at TGE, naturally this narrative has taken hold and is likely changing the way some participants are thinking about the $300m FDV price point of the ICO/Airdrop. YZiLabs is joining quite the roster of angels who are already on the cap table here, including @goodalexander who has cemented himself as somewhat of a thought leader at the intersection of Crypto and AI.

Plasma Partnership

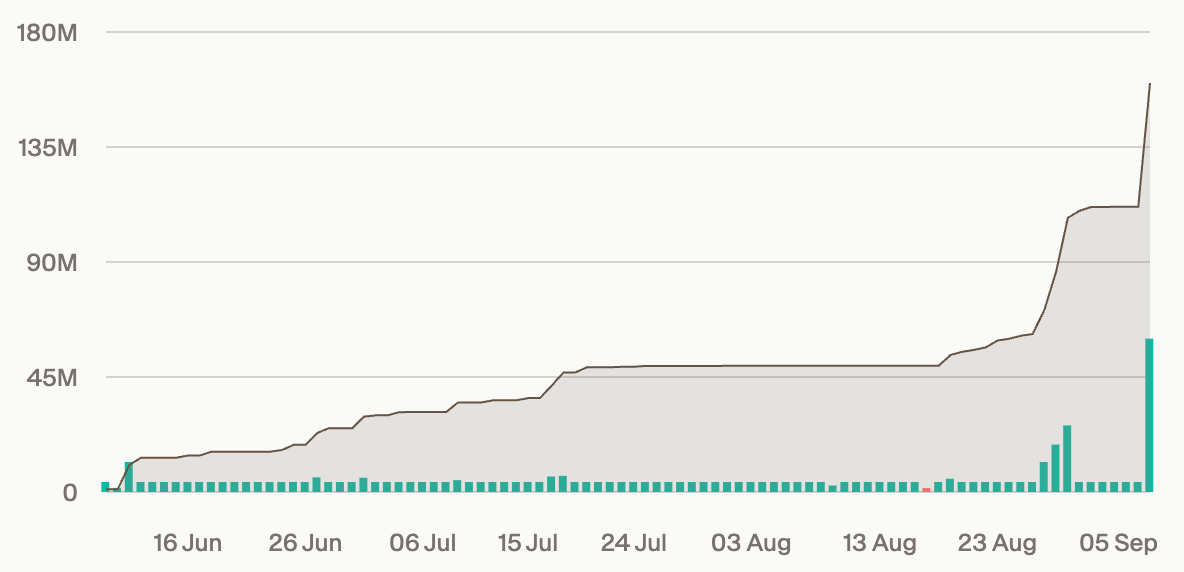

Just 2 days post the Binance Labs announcement we saw a partnership announcement between USD.AI and Plasma. If you are not familiar with Plasma, read this one I wrote 3 weeks ago for an overview. While the details of the partnership are not clear, it seems likely that USD.AI will deploy on Plasma and become a core ecosystem project over there. Yield on stables will surely be one of the core use cases which Plasma want to offer users making this partnership look very synergistic. If you expect significant activity and TVL growth on Plasma, this will be very accretive for USD.AI. Demand for anything Plasma farming has been absolutely insatiable so it is not surprising that the combination of Binance Labs and this partnership announcement led to a flurry of USDai mints (far more than at public launch itself) and the initial deposit cap of 110m being hit:

Note the significant uptick in mints/deposits around the 26-28th August right around these announcements.

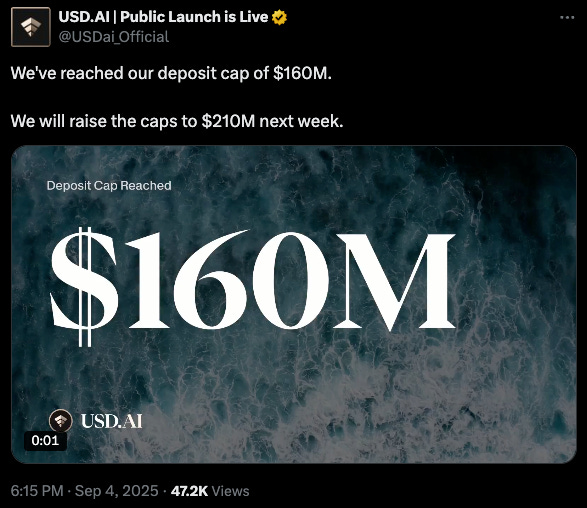

Deposit Caps lifted and hit

This one is rather self explanatory based on the screenshots above. With the initial caps set at 110m, we saw those caps lifted to 160m and filled within a very short space of time indicating the increasing interest in USD.AI and particularly the ICO/Airdrop campaign they’re running at present. These caps will be raised again by a further 50m next week so set an alarm if you want to deposit!