The four horsemen of the DeFi Renaissance

One of the most dominant narratives we have seen since the election result has been the notion of a return to utility, driven by a more favourable regulatory regime in the USA.

Markets have begun to price in the positive regulatory shift, with the following trends becoming more likely:

Crypto applications are able to return value to tokenholders under some legal framework for the first time ever, becoming “investable”

More innovation moves onshore without fear of regulatory overhang

Traditional Financial institutions (including Banks) become increasingly able to interact with Crypto

US Citizens are much more able to interact with Crypto products

With DeFi being the sector which has arguably achieved the best product market fit within Crypto (particularly stablecoins), it is only logical to assume that a positive regulatory regime will pour fuel onto an already vibrant fire.

Amid a broad based DeFi Renaissance, 4 projects seem to be standing tall, a head and shoulders above the rest in terms of on chain metrics and price performance.

Borrowing a catchphrase coined by @Arthur_0x, the four horsemen of DeFi Renaissance look to be Aave, Ethena, Aerodrome and Hyperliquid.

Before we dig a layer deeper, it’s fair to say all of these coins have handily outperformed ETH:

Let’s take a sneak peak at what is driving each one of these...

I covered the fundamental case for AAVE back in July (go back and read it here), right after the AAVEnomics proposal which bottomed the AAVE/ETH chart. The story has played out better than even I and other early AAVE bulls could have imagined...

We have seen AAVE TVL, fees and treasury continue to hit all time highs, in large part driven by the onboarding of sUSDe as collateral. This has played out something like:

Aave increases sUSDe caps

sUSDe holders borrow stables to loop the yield

Stables borrow rate begins to spike

Market supplies more stables

Stables borrow rate decreases

The process repeats

While this does increase Aave’s exposure to sUSDe over time, the economic flywheel to the upside has been very positive for Aave’s metrics.

We have also recently seen the World Liberty Financial wallet address (Trump’s DeFi project), openly accumulating AAVE on chain, adding fuel to the fire:

This brings us to Ethena which again, I discussed about a month ago in the Parsec Weekly #95. A significant increase in basis is facilitating the perfect environment for Ethena as they create a black hole for yield seeking stablecoins, powered by superior yields. sUSDe growth is relentless and does not look to be slowing down any time soon:

This is driving strong fee generation for Ethena, beating out Ethereum and Solana for the number 1 spot in terms of 24h fees today:

This brings us to Aerodrome, another project which is generating significant protocol revenues, the entirety of which is being returned to veAERO holders putting Aerodrome as the 4th largest rewarder behind entire blockchain networks:

Aerodrome continue to generate significant and increasing trading volume on the Base network with cbBTC and VIRTUAL driivng the lions share of volumes.

The final name on our list, Hyperliquid, needs no introduction to the loyal parsec weekly reader who may have enjoyed our TGE coverage a couple of weeks back:

It’s safe to say that demand for $HYPE has surprised even the most bullish of bulls, it has been absolutely insatiable and for good reason.

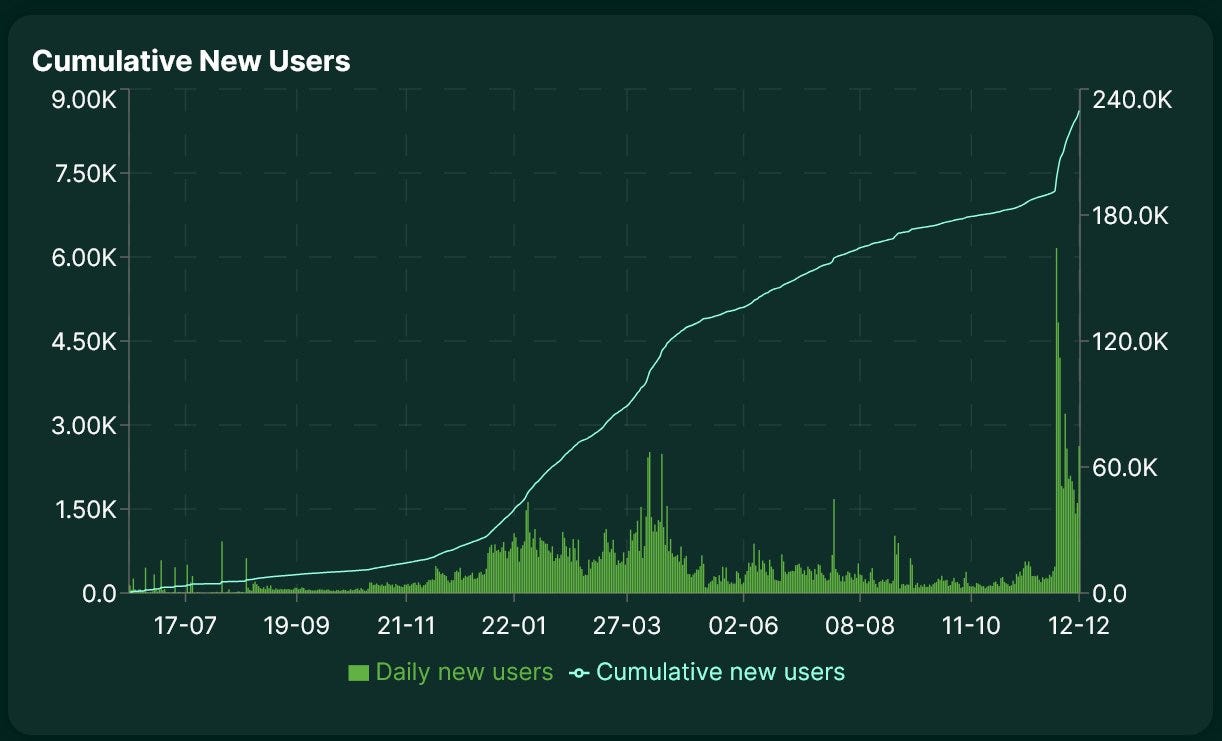

Unlike the majority of airdrops which tend to mark the top of usage for a particular chain or application as mercenary capital and users rotate away after collecting their free money, Hyperliquid has seen usage pick up meaningfully post TGE with over 40k new accounts:

Volume, OI and implied fees growth has been equally strong, breaking all time highs repeatedly post launch.

Interestingly, all of these projects have 2 things in common. The first is an element of centralisation, this seems to be a necessary ingredient for rapid growth but perhaps is less worrying this time given an easing regulatory regime and more transparent structures? The second is that all of these projects were discussed in the Parsec Weekly well in advance of their incredible outperformance, so if you’re not subscribed, make sure to do so below!

I have learnt new things here